RIDC catalyzes and supports economic growth through high quality job creation, real estate development and financing of projects that advance the public interest – developing real estate to capture emerging and existing growth opportunities across diverse industry sectors.

Greater Oakland Keystone Innovation Zone

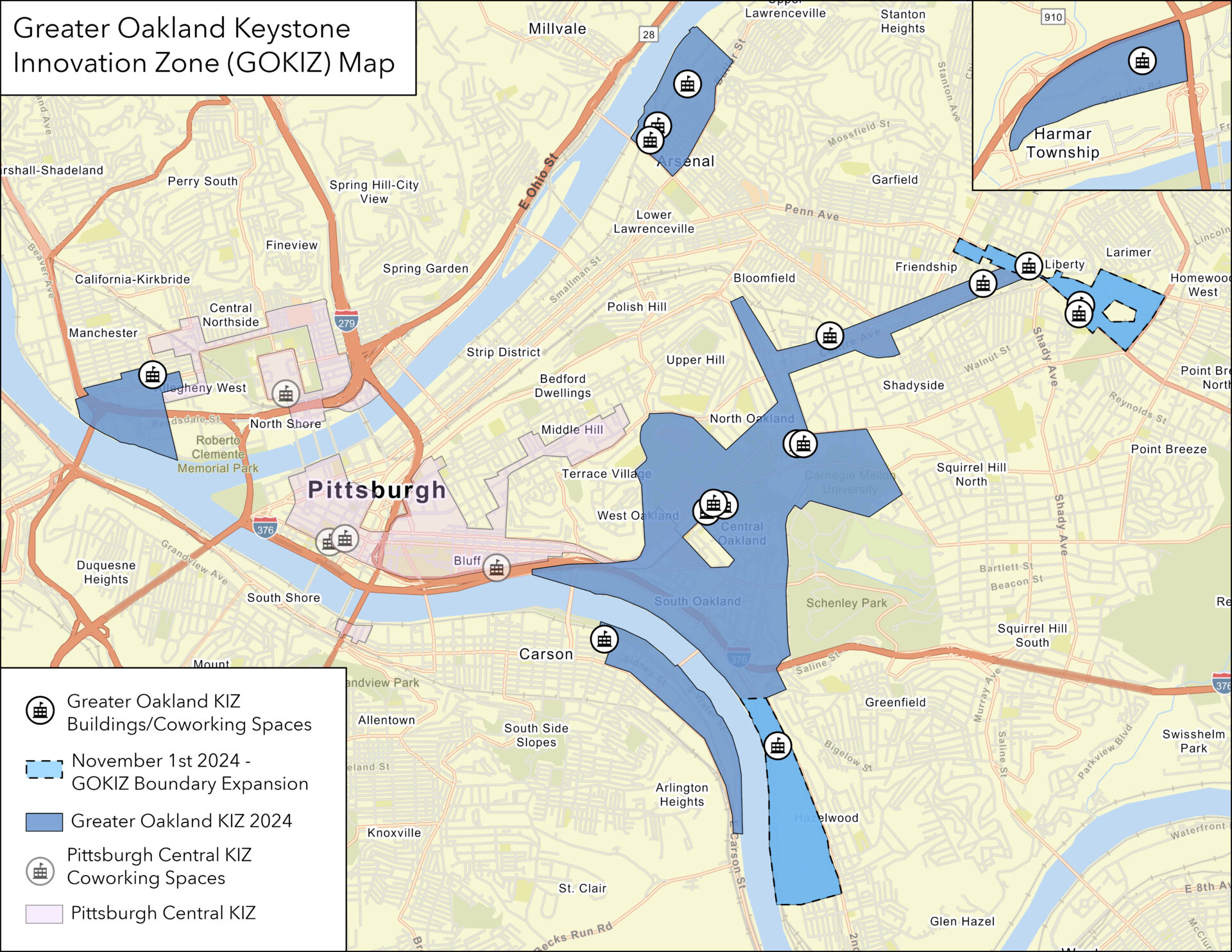

Companies must be located within the shaded boundaries of the GOKIZ shown in the map above. Nearby or adjacent locations are not eligible.

Greater Oakland Innovation Zone Map

Click on image to view interactive map with additional information.

Thank you to CivicMapper for creating boundary files for the Pittsburgh Central and Greater Oakland KIZ!

Overview

RIDC is the administrator for the Greater Oakland Keystone Innovation Zone (GOKIZ), part of a Pennsylvania Department of Community and Economic Development tax credit program that provides tax credits to for-profit companies less than eight years old operating in innovation industries within the boundaries of a Keystone Innovation Zone (KIZ). With a total pool of up to $15 million in tax credits available to KIZ companies annually, this program significantly contributes to the ability of young companies to transition through the stages of growth.

This year’s application opens September 2025 with all applications due by December 1, 2025.

Eligibility

KIZ companies must:

1). Be located within the geographic boundaries of a particular KIZ for at least two years

a. 50% of employees must be based in person in that location for at least 50% of their time

2). Be in operation less than 8 years

3). Operate within one of the KIZ targeted innovation industry segments or sectors

a. Advanced Materials/Diversified Manufacturing, Energy, Life Sciences, & Robotics and Technology

4). Show an increase in revenue between the base year (2022) and comparable year (2023)

5). Submit required documentation to the KIZ Coordinator (RIDC) and to DCED. Documentation will be requested once the company contacts RIDC for intake.

Tax Credit Calculation

For the 2025 KIZ application cycle, a KIZ company may claim a tax credit equal to 50% of the increase in that Company’s gross revenues in the immediately preceding taxable year, 2024 (comparable year), over the KIZ Company’s gross revenues in the second preceding taxable year, 2023 (base year). Only revenue attributable to the KIZ location can be included in the calculation. The KIZ Tax Credit is limited to $100,000 annually per company.

Example:

2023 Base Year Revenue: $100,000

2024 Comparable Year Revenue: $200,000

Increase= $100,000

Tax Credit (50% of increase): $50,000

Learn More

Read more about the KIZ program at Keystone Innovation Zone (KIZ) Tax Credit Program (pa.gov) or contact your GOKIZ Coordinator, Sophie Beacom, at gokiz@ridc.org for information on how to apply for the Greater Oakland KIZ program.

For information on the Pittsburgh Central KIZ, contact Tiara Flowers at tf@colab18.org.

Frequently Asked Questions

How can I apply for a KIZ tax credit?

- Companies must file an application through DCED’s Electronic Single Application (ESA). Before applying, you’ll need to get in touch with your Greater Oakland KIZ Coordinator (gokiz@ridc.org) to schedule a site visit, submit documentation and confirm eligibility.

What can I do with a KIZ tax credit?

- The KIZ Tax Credit must first be applied against the KIZ company’s own tax liability under Articles III (Personal Income Tax), or IV (Corporate Net Income Tax) of the Pennsylvania Tax Reform Code of 1971. Unused KIZ Tax Credits may applied against the tax liability of the KIZ company for up to five years from date the KIZ Tax Credit is issued or may be reassigned/sold to another taxpayer.

When can I apply for a KIZ tax credit?

- Applications open in mid-September and are due December 1st of each year. Given the timing of the Thanksgiving holiday in 2025, we strongly encourage applicants to submit by November 26th at the latest to ensure RIDC can fully support your application as the GOKIZ Coordinator. Award letters are emailed to KIZ companies by May 1st of the following year.

About RIDC

Read more about how we’re connecting our region’s past to its future.