Prepared by: Simon Tripp, Joseph Simkins, Deborah Cummings, Martin Grueber, and Dylan Yetter at TEConomy Partners, LLC

Performed for: Regional Industrial Development Corporation and the Greater Pittsburgh Chamber of Commerce, with funding support provided by the Richard King Mellon Foundation

With special thanks to the autonomy steering committee: the RK Mellon Foundation, Carnegie Mellon University, Greater Pittsburgh Chamber of Commerce, Regional Industrial Development Corporation (RIDC), Pittsburgh Technology Council, Pittsburgh Robotics Network, Argo AI, Aurora, and Thoro.ai

A new report issued by the Regional Industrial Development Corporation (RIDC) and the Greater Pittsburgh Chamber of Commerce with research conducted by TEConomy Partners confirms autonomy’s regional growth and recommends strategic action for the region.

The culmination of a nine months-long study — “Forefront: Securing Pittsburgh’s Break-out Position in Autonomous Mobile Systems” — finds that the Pittsburgh region is well-positioned to become one of the top centers for autonomous mobile systems — a sector predicted to grow to a $1 trillion+ global market by 2026, with an estimated 5,000 jobs and a $10 billion impact for a region that captures 1 percent of that global market growth.

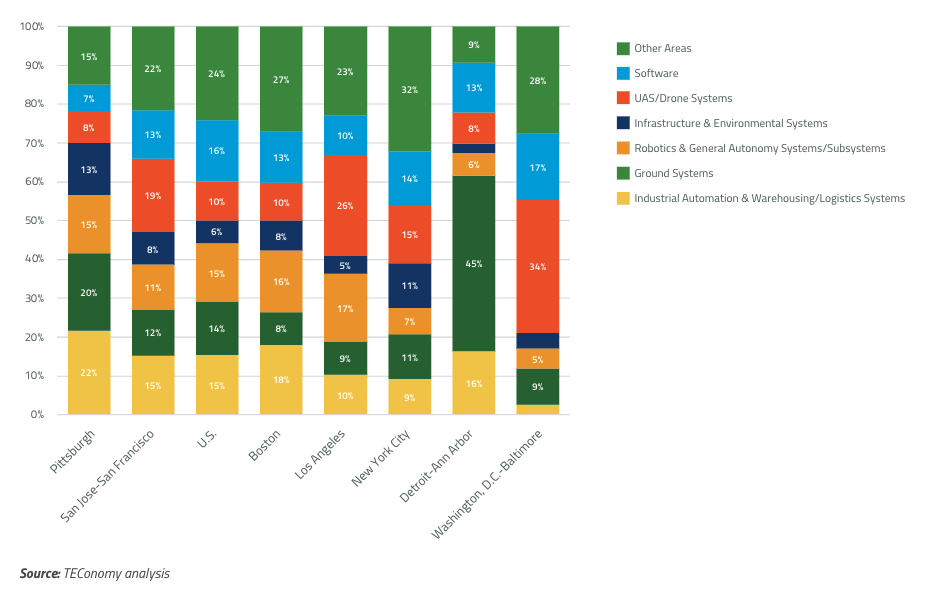

The Pittsburgh autonomy sector has grown from an emerging to an established cluster with the potential to serve as an economic development engine for the region. TEConomy analyzed the economic impact of 71 local firms (or in cases of major multinational corporations, the divisions, or operating units of those firms), which were identified as having core business operations primarily serving the autonomy sector.

The estimated direct employment footprint of Pittsburgh’s autonomy sector totals over 6,300 jobs which provide an estimated $651 million in labor income, $34.7 million in state and local tax revenues, and $126.7 million in federal tax revenues. These companies generated an additional 8,604 full- or part-time indirect jobs, bringing the total number of jobs in the region that are dependent on the industry to 14,923 jobs.

Other key findings include:

Other states are and have been investing in signature state programs, incentives, and infrastructure for autonomy

While Pittsburgh is an R&D center, companies are choosing to locate testing infrastructure investments and jobs in other states

Much of the sector’s growth to date has been organic, but coordinated support is needed to progress

Although Pittsburgh is an established hub, its gains are at risk due to regional competition, a challenging regulatory environment for testing and deployment, and insufficient coordinated support for the sector, the study found.

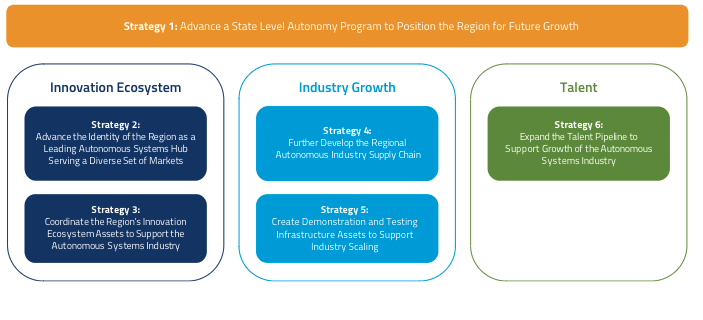

The study offers a six-part strategic plan with specific strategies to reinforce the region’s current strengths, attract and retain talent, and root emerging companies in the region.

While autonomous on-road vehicles are the mostly widely known applications of autonomy, they are only a part of a much wider landscape for autonomous mobile systems applications. Enabled by new technology convergence areas, significant change is coming to physical devices of any scale that both move and may be equipped with some form of sensing and decision-making system to intelligently perform tasks and navigate their environment. Many tasks that require human or machine spatial movement are potential prospects for automated mobile systems approaches, and this opens up vast and diverse market potentials for disruptive industries.